Automate and Innovate: Your Guide to AI in Claims Processing

Cut Claims Processing from Weeks to Minutes with AI

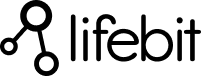

AI for claims processing is revolutionizing how insurers handle claims, delivering faster settlements, higher accuracy, and better customer experiences. AI automates manual work, reducing document review time by up to 80% and cutting claims leakage from 12% down to 2%. The result is processing times slashed from weeks to minutes, with 96% accuracy in decisions.

The insurance industry is struggling. 31% of policyholders are dissatisfied with recent claims, and 60% blame slow settlement speeds. Meanwhile, handlers spend 30% of their time on low-value work, as traditional automation only handles 7% of claims straight through. This leads to frustrated customers and lost revenue.

AI fixes this by understanding complex documents, flagging fraud in real-time, and intelligently routing claims. This guide shows you how AI transforms the entire claims lifecycle.

I’m Maria Chatzou Dunford, CEO and Co-founder of Lifebit. We specialize in AI-powered data platforms for complex, siloed datasets. While our focus is often biomedical data, the core principles of automating workflows and ensuring data quality are universal to AI implementation.

Stop Leaking 12% of Revenue on Broken Claims Processing

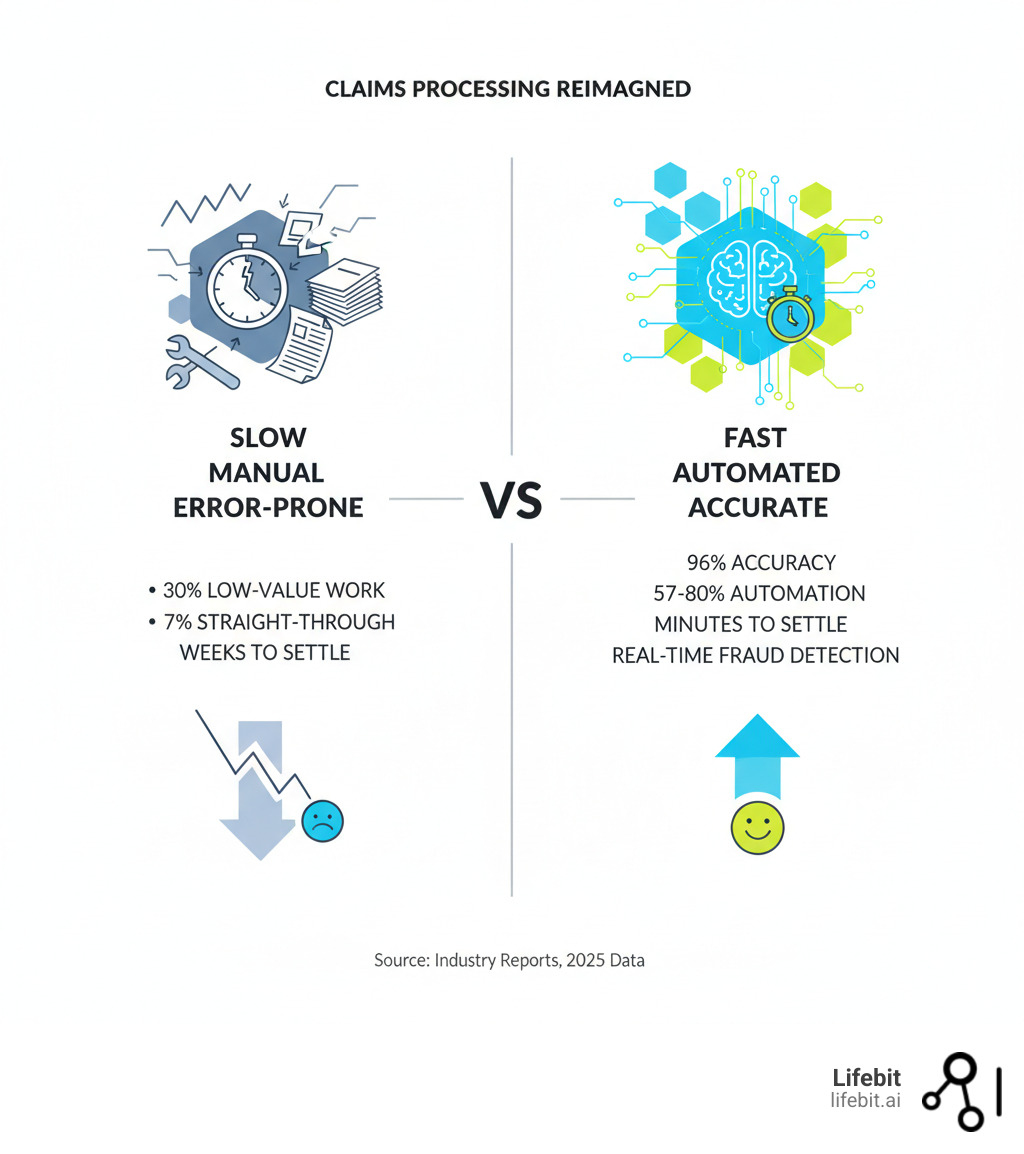

Picture a claims adjuster buried under paperwork: coffee-stained police reports, handwritten notes, and faxed medical records. Each claim requires manual review, cross-referencing, and data entry. Now, picture another adjuster using an AI interface that has already extracted key information, flagged issues, and suggested a settlement amount in minutes. This is the reality of AI for claims processing.

The Crippling Limits of Rules-Based Automation

For years, insurers relied on rules-based automation, which works for simple, predictable tasks. The problem? Most claims data is unstructured—police reports, medical records, photos, and handwritten notes don’t fit into neat boxes.

As a result, only 7% of claims are processed straight through. The other 93% require manual review, with claims handlers spending 30% of their time on low-value work like data entry. This manual dependency leads to “claims leakage”—unnecessary payouts or missed recoveries—costing the average insurer 8-12% of their revenue.

Policyholders are also unhappy. An industry report found that 31% of claimants were dissatisfied, with 60% citing slow settlement speed.

The AI Advantage: Speed, Accuracy, and Intelligence

AI for claims processing understands unstructured data like a human, but faster and more consistently. It can analyze a police report, estimate repair costs from photos, and identify relevant injuries from medical records.

A large travel insurer processing 400,000 claims per year manually deployed an AI solution and achieved 57% automation almost overnight, cutting processing time from weeks to minutes. AI systems are also achieving 96% accuracy rates, helping reduce claims leakage to the best-in-class standard of 2-3%.

AI doesn’t replace adjusters; it empowers them. By automating grunt work, AI lets adjusters focus on complex cases and customer relationships. This matters, as 62% of customers stay after a good claims experience, compared to only 19% after a bad one. Younger policyholders already prefer AI, with 40% of 18-24 year olds wanting insurers that use it.

At Lifebit, we see similar patterns when researchers use our AI tools to process complex biomedical data. By automating data wrangling, they can focus on scientific findy. The same principle applies to claims. For more on this, see our resources on AI healthcare solutions. The shift to AI is about reimagining the claims experience for everyone.

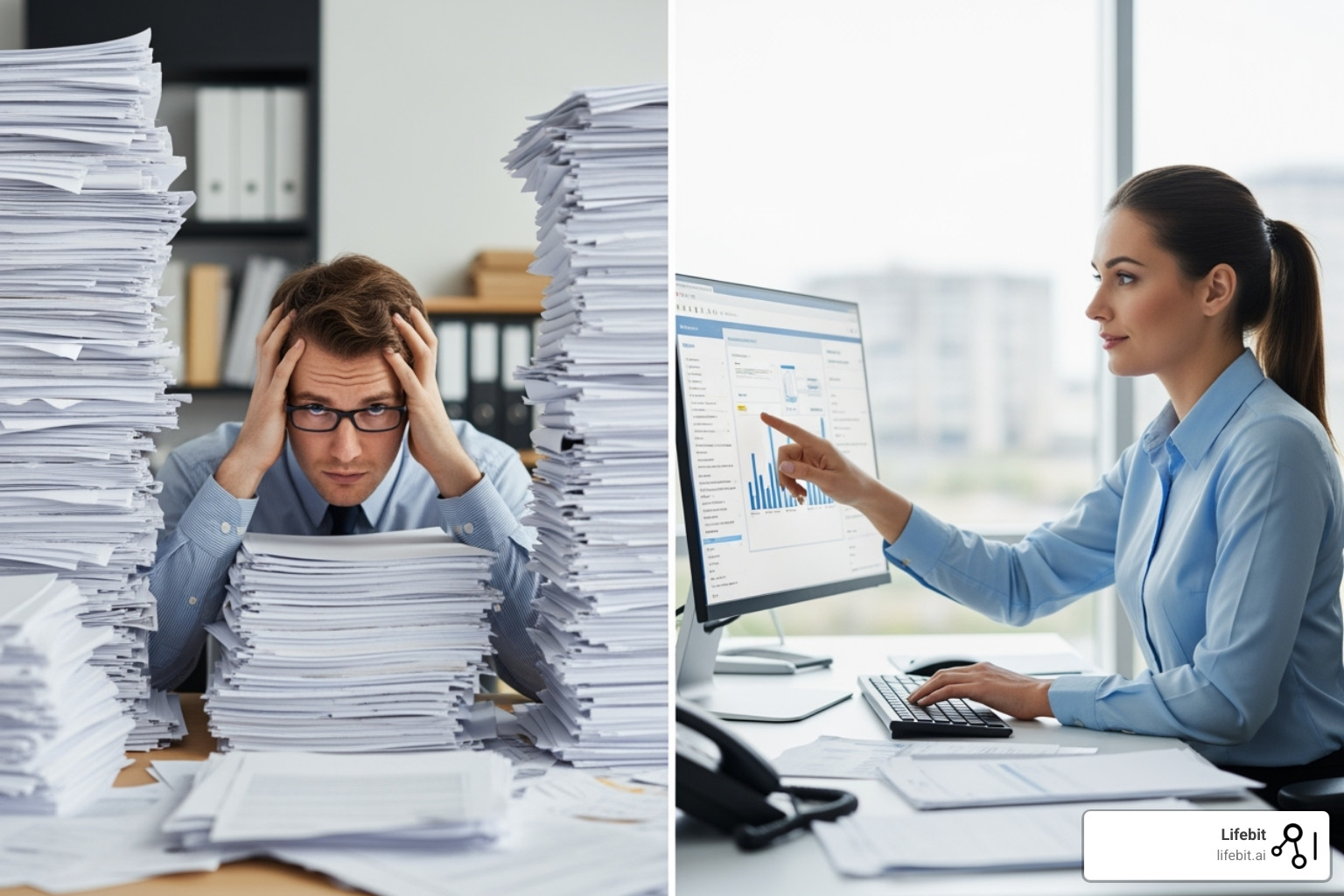

The 3 AI Technologies Slashing Claims Costs

The change in AI for claims processing is powered by three core technologies working together to understand and analyze complex claims data.

Machine Learning and Predictive Analytics

Machine Learning (ML) algorithms learn from historical claims data to spot patterns, assess risks, and predict outcomes. When a new claim arrives, ML models can instantly analyze it to predict its complexity and potential cost. For instance, regression models can predict the likely settlement cost based on thousands of similar past claims, while classification algorithms can categorize a claim’s complexity (e.g., ‘simple,’ ‘complex,’ ‘potentially fraudulent’) with high accuracy. This allows insurers to automatically triage claims, fast-tracking simple ones and flagging complex cases for experienced adjusters. ML provides data-driven insights that lead to faster, more consistent decisions, such as forecasting settlement amounts or repair costs with a degree of accuracy that surpasses human intuition alone.

At Lifebit, we use similar ML approaches in AI for medical research, teaching machines to find meaningful signals in messy, real-world data.

The Rise of Generative AI in Claims

Generative AI (GenAI) creates new content, such as summaries and reports, which is transformative for an industry drowning in unstructured documents. GenAI can read a police report, cross-reference it with medical records, and generate a concise summary for an adjuster in seconds. Beyond summaries, GenAI can draft empathetic and personalized email updates for policyholders, generate initial drafts of denial or approval letters for adjusters to review, and even create synthetic but realistic claims data to train other AI models without using sensitive customer information. It can also draft personalized updates for policyholders and answer questions via chatbots.

Swiss Re’s ClaimsGenAI demonstrates this by actively hunting for subrogation opportunities, identifying hundreds of potential third-party recoveries and creating a fraud savings pipeline worth millions. It achieves this by cross-referencing unstructured claim notes with legal precedents and third-party data sources to build a case for recovery. The ability to harmonize diverse data formats is crucial, a challenge we address at Lifebit with our expertise in AI for data harmonization.

Computer Vision for Damage Assessment

Computer Vision (CV) brings AI’s analytical power to images and videos, enabling automated damage assessment for property and auto claims. When a policyholder submits photos of a damaged vehicle, CV algorithms can analyze the images to assess severity and generate repair cost estimates, often without an on-site inspection. This process involves identifying the make and model of the vehicle, segmenting the damaged areas, classifying the type of damage (e.g., dent, scratch, shattered glass), and cross-referencing this analysis with manufacturer part catalogs and local labor rate databases to generate a highly accurate preliminary estimate.

CV is also a powerful fraud detection tool. In one case, an AI-powered photo similarity scoring system flagged that photos submitted for a weather damage claim had been used in three prior claims, preventing a fraudulent payout. This technology can also analyze satellite imagery for property claims to verify damage from events like wildfires or hurricanes before an adjuster can even reach the site.

These three technologies—ML, GenAI, and CV—form the foundation of modern AI for claims processing, creating a system that is faster, smarter, and more accurate than ever before.

From Weeks to Hours: AI’s Real-World Impact on Claims

The power of AI for claims processing is evident in its daily impact on insurer operations, redefining speed, accuracy, and customer satisfaction from first notice to final settlement.

From First Notice of Loss (FNOL) to Settlement

The claims process often begins when policyholders are most stressed. AI for claims processing provides immediate relief.

AI-powered chatbots handle initial claim intake 24/7, guiding policyholders through the process without hold times. They can ask clarifying questions, confirm policy coverage in real time, and provide a list of required documents. Once submitted, intelligent triage instantly categorizes the claim. This triage doesn’t just look at the claim type; it analyzes the claimant’s policy details, their claims history, and the sentiment of their initial report to route it effectively. A low-value, single-vehicle property damage claim from a long-term customer with a clean history might be fast-tracked for immediate settlement, while a complex bodily injury claim with ambiguous details is immediately flagged for a senior adjuster. Simultaneously, automated data extraction pulls key information from documents, eliminating manual entry.

For simple claims, straight-through processing takes over, moving from submission to settlement with minimal human intervention. Some systems can now settle over 60% of claims in real time. This speed is critical: 21% of customers want claims settled in hours, but 43% currently wait over two weeks. Closing this gap is key, as 62% of customers stay after a good experience, while only 19% stay after a bad one.

Advanced Fraud Detection and Investigation

Insurance fraud costs the industry billions annually. Traditional detection methods, often based on static rules and manual reviews, are easily gamed. AI changes the game by making detection dynamic and proactive.

AI uses pattern recognition and anomaly detection to analyze vast datasets, spotting inconsistencies that humans would miss. Beyond network analysis, AI employs behavioral analytics to flag suspicious patterns, such as a claimant repeatedly logging in from different locations in a short time or submitting a claim moments after a policy change. It also uses text mining to detect inconsistencies between a recorded statement and a written report. Network analysis uncovers hidden connections between seemingly unrelated claims, revealing organized fraud rings by linking common doctors, lawyers, or addresses across multiple claims.

AI screens every claim for fraud in real-time without slowing down legitimate ones. Swiss Re’s ClaimsGenAI tool generated over 1,000 alerts for irregularities in its first year, contributing to a fraud savings pipeline worth millions. In one example, AI’s photo similarity scoring caught an individual reusing images from three prior claims, instantly stopping a fraudulent payout. This multi-layered, real-time screening is a paradigm shift from the traditional batch-based, rules-driven systems that were easier to circumvent. You can see the power of AI in action here.

Uncovering Hidden Subrogation Opportunities

Subrogation—recovering costs from a responsible third party—is valuable but complex and often underutilized. Many opportunities are missed due to time constraints and the difficulty of manually piecing together evidence.

AI for claims processing systematically evaluates every claim for subrogation potential. GenAI models analyze claim details against complex legal criteria to identify when a third party may be liable. Consider a commercial property claim for water damage. A human adjuster, pressed for time, might focus on paying the claim. An AI, however, can scan maintenance logs, weather data, and public records in seconds. It might discover that a municipal water main broke nearby on the same day, or that a third-party contractor had recently performed work on the building’s plumbing. The AI can then flag this as a high-potential subrogation case and even generate a preliminary report outlining the evidence for the recovery team. One insurer used GenAI to uncover a subrogation opportunity in a state with stringent legal criteria, leading to increased recovery rates. By consistently identifying third-party liability, AI ensures insurers recover funds that would otherwise be lost.

At Lifebit, our expertise in AI-enabled data governance ensures that the complex data required for these analyses is handled with the utmost security and compliance.

Your Roadmap to Implementing AI in Claims

Implementing AI for claims processing is a strategic journey, not a simple switch. Success starts with a solid foundation and a clear-eyed view of the path ahead.

Key Considerations for a Successful Strategy

Data quality and governance are the bedrock of any AI initiative. Your AI model is only as good as the data it’s trained on. This means ensuring data is clean, accurate, and organized with clear lineage and robust access controls. Before any algorithm is built, insurers must invest in data cleansing, standardization, and enrichment. At Lifebit, our federated platform is built on these principles, enabling secure access to complex datasets while maintaining strict governance.

Your technology stack must also be ready. Legacy systems often hinder AI adoption. Many insurers are moving to scalable, flexible cloud-based solutions that can handle the massive computational demands of AI. The build, buy, or partner decision is critical. Building in-house offers maximum control and customization but requires significant upfront investment and specialized talent. Buying an off-the-shelf solution is faster to deploy but may lack flexibility and be difficult to integrate. Partnering with AI specialists often provides the best balance, leveraging external expertise and proven technology while you focus on serving policyholders. Our guide to AI platform healthcare explores similar decisions.

Crucially, a successful strategy requires robust change management. AI is not just a technology project; it’s a business transformation. Leaders must communicate a clear vision of how AI will empower employees, not replace them. It automates the 30% of a claims handler’s time spent on low-value tasks, freeing them for complex cases. This requires talent upskilling and creating training programs so your team can work alongside AI, interpret its insights, and apply human judgment. Gaining early buy-in from the claims team is essential for smooth adoption and maximizing ROI.

Overcoming Challenges: Ensuring Accuracy, Ethics, and Trust

Trust is paramount, as 83% of consumers are wary of agentic AI in insurance. To build it, you must proactively address key challenges.

- Data Bias: AI trained on biased historical data will perpetuate those biases. For example, if past data shows higher denial rates in certain geographic areas for non-risk reasons, the AI will learn and amplify this unfairness. Rigorous testing, bias detection tools, and the use of diverse, representative training datasets are essential to ensure fairness and equity.

- Model Explainability: “Black box” AI is unacceptable in a regulated industry. Explainable AI (XAI) is crucial, providing clear reasoning for every decision. Instead of a simple ‘denied’ output, an XAI system can provide a rationale like: ‘Claim flagged for review because the damage described in the report is inconsistent with the submitted photos, and the repair estimate exceeds the 95th percentile for similar cases.’ This transparency builds trust with your team, regulators, and policyholders.

- Regulatory Compliance: AI systems must comply with data privacy laws like GDPR and the California Consumer Privacy Act (CCPA), as well as evolving state-level AI-specific legislation. Adherence to the NAIC’s AI Principles (Fair and Ethical, Accountable, Compliant, Transparent, and Secure) is becoming the industry standard. Security standards like ISO27001 are non-negotiable. Our work in AI for regulatory compliance shows that building in compliance from day one is key.

- Human-in-the-Loop: AI should augment, not replace, human expertise. The final decision, especially on complex, sensitive, or denied claims, should rest with a human expert who brings empathy, context, and ethical judgment that an algorithm lacks.

- Continuous Monitoring: AI models are not ‘set and forget.’ They require regular monitoring and retraining to stay accurate, fair, and compliant as new data emerges, customer behavior changes, and fraud patterns evolve. This process, known as MLOps (Machine Learning Operations), is critical for long-term success.

The Future of AI in Claims: What’s Next?

The future is arriving quickly. Agentic AI—systems capable of autonomous decision-making and action—is already a reality for straightforward claims. Hyper-personalization will use AI and diverse data sources (with customer consent) to offer personalized pricing, risk prevention advice, and services. IoT integration and telematics will make claims processing nearly instantaneous, with a car’s sensors automatically reporting an accident, documenting the impact, and initiating the claim before the driver even makes a call.

The role of adjusters will evolve from data processors to strategic advisors focused on high-value activities where empathy and judgment are irreplaceable. As McKinsey highlights, organizations that invest in claims AI today will thrive in the transformed landscape. The question isn’t if AI will transform claims, but whether your organization will lead the change.

Your AI in Claims Questions, Answered

Will AI replace claims adjusters?

No. AI is here to make adjusters better at their jobs, not replace them. It automates the 30% of time handlers spend on repetitive, low-value tasks like data entry. This frees them to focus on what humans do best: handling complex cases, connecting with customers, and making strategic decisions. Their roles evolve from data processors to more valuable strategic problem-solvers.

How much does it cost to implement AI for claims?

The honest answer is: it depends. But the Return on Investment (ROI) is significant and measurable. AI delivers ROI by cutting operational costs, reducing claims leakage from 8-12% to 2-3%, and stopping millions in fraud. Furthermore, improved customer experiences drive retention—62% of customers stay after a good experience, versus 19% after a bad one. The real question is the cost of not implementing AI while competitors advance.

Is AI-driven claims processing secure?

Yes. Security is foundational to AI for claims processing. Reputable solutions are built on robust data governance frameworks, including strong encryption, strict access controls, and regular security audits. Compliance with regulations like GDPR and standards like ISO/IEC 27001:2022 is standard practice.

At Lifebit, our platforms are designed for the world’s most sensitive biomedical data, using federated governance and secure architectures. These same principles ensure your claims data is protected. When implemented correctly, AI-driven processing is often more secure than manual processes prone to human error.

The Future of Claims is Here. Are You Ready?

The insurance industry is at a crossroads. The old way of handling claims—manual, slow, and inefficient—is no longer sustainable. AI for claims processing is a strategic imperative for any insurer who wants to thrive.

Throughout this guide, we’ve seen how AI cuts processing time from weeks to minutes, achieves 96% accuracy, reduces claims leakage to 2-3%, and turns dissatisfied customers into loyal advocates.

However, AI is only as powerful as the data foundation it’s built on. Success requires high-quality data, robust governance, and secure infrastructure. You must treat data as your most valuable strategic asset.

At Lifebit, we build platforms to manage the world’s most complex and sensitive data. Our federated AI platform provides the secure, compliant, and AI-ready data foundation needed to open up the full potential of AI in claims. The principles that guide our work in biomedical research—data harmonization, federated governance, and real-time analytics—are exactly what the insurance industry needs.

The question isn’t whether to adopt AI, but whether you’re ready to build the foundation that makes it transformative.

Discover how to build your AI-ready data foundation with Lifebit and turn your claims processing into a powerhouse of speed and accuracy.