The Global Patient Registry Software Market is Booming

Global Patient Registry Software Market: Kill Data Silos and Scale to $6.78B

The global patient registry software market is projected to surge from $2.38 billion in 2025 to $6.78 billion by 2035, representing a compound annual growth rate (CAGR) of 11.04%. This explosive growth is driven by the rising burden of chronic diseases, accelerated adoption of electronic health records (EHRs), and government mandates for real-world evidence generation. As healthcare systems transition from volume-based to value-based care, the ability to track patient outcomes over long periods has become a strategic necessity rather than a luxury.

Key Market Growth Drivers in Detail:

- Chronic Disease Prevalence: Aging populations and conditions like diabetes, cancer, and cardiovascular disease are fueling demand for long-term patient tracking. For instance, the World Health Organization (WHO) estimates that chronic diseases will account for 73% of all deaths globally by 2025. Managing these populations requires longitudinal data that only sophisticated registry software can provide.

- EHR Integration and Maturity: 88% of U.S. office-based physicians adopted EHRs by 2021, creating a foundation for automated registry data collection. However, the market is now moving beyond simple adoption toward “meaningful use” and interoperability, where registry software acts as the analytical layer on top of raw EHR data.

- Regulatory Pressure and the 21st Century Cures Act: Government initiatives worldwide mandate post-marketing surveillance and population health reporting. In the U.S., the 21st Century Cures Act has placed a heavy emphasis on the use of Real-World Evidence (RWE) to support regulatory decision-making, directly boosting the registry software sector.

- Real-World Evidence (RWE): Pharmaceutical companies increasingly rely on registry data for regulatory submissions and safety monitoring. RWE provides insights into how drugs perform in diverse, non-controlled populations, which is essential for expanding indications and ensuring long-term safety.

- Value-Based Care Models: Hospitals need registries to benchmark quality, reduce readmissions, and support population health management. Under value-based reimbursement, providers are penalized for poor outcomes, making the tracking capabilities of registry software vital for financial stability.

The market is segmented by registry type (disease, product, health service), software type (standalone vs. integrated), deployment model (on-premise vs. cloud), and end user (government, hospitals, pharma, research centers). Disease registries currently dominate with 52.4% market share, while cloud-based solutions are growing fastest due to lower upfront costs and easier multi-site data sharing.

North America leads the market with 48.6% share in 2025, driven by advanced healthcare IT infrastructure and strong regulatory frameworks. However, Asia Pacific is the fastest-growing region, with countries like China and India investing heavily in digital health programs and national registry initiatives.

Major challenges include:

- Data privacy and security concerns (35.5% of U.S. data breaches in 2019 occurred in healthcare)

- Interoperability issues when integrating legacy EHR systems

- Lack of standardization across regional and national registry formats

- Limited awareness in developing markets about registry software benefits

As CEO and Co-founder of Lifebit, I’ve spent over 15 years building federated platforms that enable secure, compliant access to global biomedical data. The global patient registry software market is shifting toward AI-enabled, cloud-native architectures that allow multi-site collaboration without moving sensitive patient data—a change that’s critical for accelerating drug discovery and real-world evidence generation.

Global patient registry software market word guide:

Global Patient Registry Software Market: Why $6.78B is Shifting to Real-World Evidence

The sheer scale of the global patient registry software market growth is hard to ignore. We are looking at a market that was valued at roughly $1.6 billion in 2023 and is now racing toward a $6.78 billion valuation by 2035. But why now? The answer lies in the limitations of traditional clinical research and the urgent need for more inclusive data.

The “why” is a perfect storm of clinical need and technological capability. For years, what are patient registries remained manual, paper-heavy silos. Today, the prevalence of chronic diseases like diabetes and cancer has reached a tipping point, requiring more sophisticated tracking. Governments are also stepping in; they have realized that observational data from registries often provides a more realistic view of patient outcomes than highly controlled, randomized clinical trials (RCTs).

The Limitations of Randomized Clinical Trials (RCTs)

While RCTs are the gold standard for proving efficacy, they often exclude the very patients who will use the drug in the real world—such as the elderly, patients with multiple comorbidities, or those on concurrent medications. This is where the global patient registry software market fills the gap. Registries capture data from the “average” patient, providing a wealth of information on long-term safety and effectiveness that RCTs simply cannot capture due to their limited duration and strict inclusion criteria.

The Shift Toward Value-Based Care

Furthermore, the shift toward value-based care means hospitals are no longer just paid for the number of procedures they perform, but for the quality of the outcomes they achieve. To prove these outcomes, they need robust software. Understanding what are patient registries why are they important is the first step for any organization looking to survive this shift. Registries allow us to examine prognosis factors, describe care patterns, and measure the clinical and cost-effectiveness of treatments in the real world.

In this new paradigm, data is the currency. Payers (insurance companies and governments) are increasingly demanding registry data before they agree to reimburse for expensive new therapies. This “pay-for-performance” model is a massive tailwind for the registry software market, as it forces providers to invest in tools that can accurately track and report patient health trajectories over years, not just days.

Global Patient Registry Software Market: Why Disease Registries Own 52% Share

When we look at how the global patient registry software market is divided, two heavyweights emerge: Disease Registries and Product Registries. Each serves a distinct purpose in the healthcare ecosystem, but both are evolving rapidly through digital transformation.

Disease Registries currently hold the lion’s share of the market, accounting for over 50% of revenue. These are essential for tracking specific conditions—think the Diabetes Collaborative Registry or oncology databases like the SEER program. They help clinicians understand the natural history of a disease and identify which treatments work best for specific patient subgroups. You can explore more about disease registers to see how they function as specialized tools for long-term health management. These registries are particularly vital for rare diseases, where patient populations are small and scattered; a centralized software platform allows researchers to aggregate enough data to find statistically significant patterns.

Product Registries, on the other hand, focus on medical devices or specific drugs. These are often mandated by regulatory bodies like the FDA or EMA for post-marketing surveillance. If a new heart valve or orthopedic implant is released, a product registry ensures that every patient who receives it is tracked for safety and efficacy over several years. This is a critical component of the “Total Product Life Cycle” approach to medical device regulation, ensuring that any unforeseen complications are caught early.

Health Service Registries are the third, smaller segment, focusing on the quality of care provided for specific procedures, such as joint replacements or cardiac surgeries. These are primarily used by hospitals to benchmark their performance against national standards.

Standalone vs. Integrated Software: The Great Convergence

Another key battleground is Standalone vs. Integrated Software. While standalone solutions offer deep, specialized features, the market is moving rapidly toward integrated systems that live within the EHR environment.

| Feature | Standalone Software | Integrated Software (EHR-Linked) |

|---|---|---|

| Data Entry | Manual or custom import | Automated via EHR sync (FHIR/HL7) |

| Specialization | High (disease-specific) | General (population-wide) |

| Workflow | Separate from clinical tools | Embedded in daily clinician workflow |

| Cost | Lower initial cost | Higher, part of larger IT suite |

| Growth Trend | Steady | Rapidly Increasing |

According to scientific research on patient registry definitions and outcomes, the ultimate goal is to collect uniform data to evaluate specified outcomes. Integrated software makes this “uniformity” much easier to achieve by pulling data directly from the point of care, reducing the administrative burden on clinicians and minimizing human error in data entry. As the global patient registry software market matures, we expect to see standalone vendors increasingly offering robust APIs to ensure they can function as part of an integrated ecosystem.

Global Patient Registry Software Market: Stop Data Breaches with Federated AI

Privacy is the elephant in the room. With healthcare accounting for over 35% of all data breaches, the global patient registry software market has had to innovate or die. The sensitivity of registry data—which often includes genetic information, lifestyle data, and long-term health histories—makes it a prime target for cybercriminals. This is where we see the most exciting technological shifts.

Cloud-based deployment has become the standard. It offers the scalability that hospitals and research centers need without the massive upfront costs of on-premise servers. But more importantly, cloud-native platforms are now incorporating AI and Machine Learning to automate data cleaning and validation. In the past, cleaning registry data was a manual process that could take months; today, AI algorithms can identify outliers and missing values in real-time.

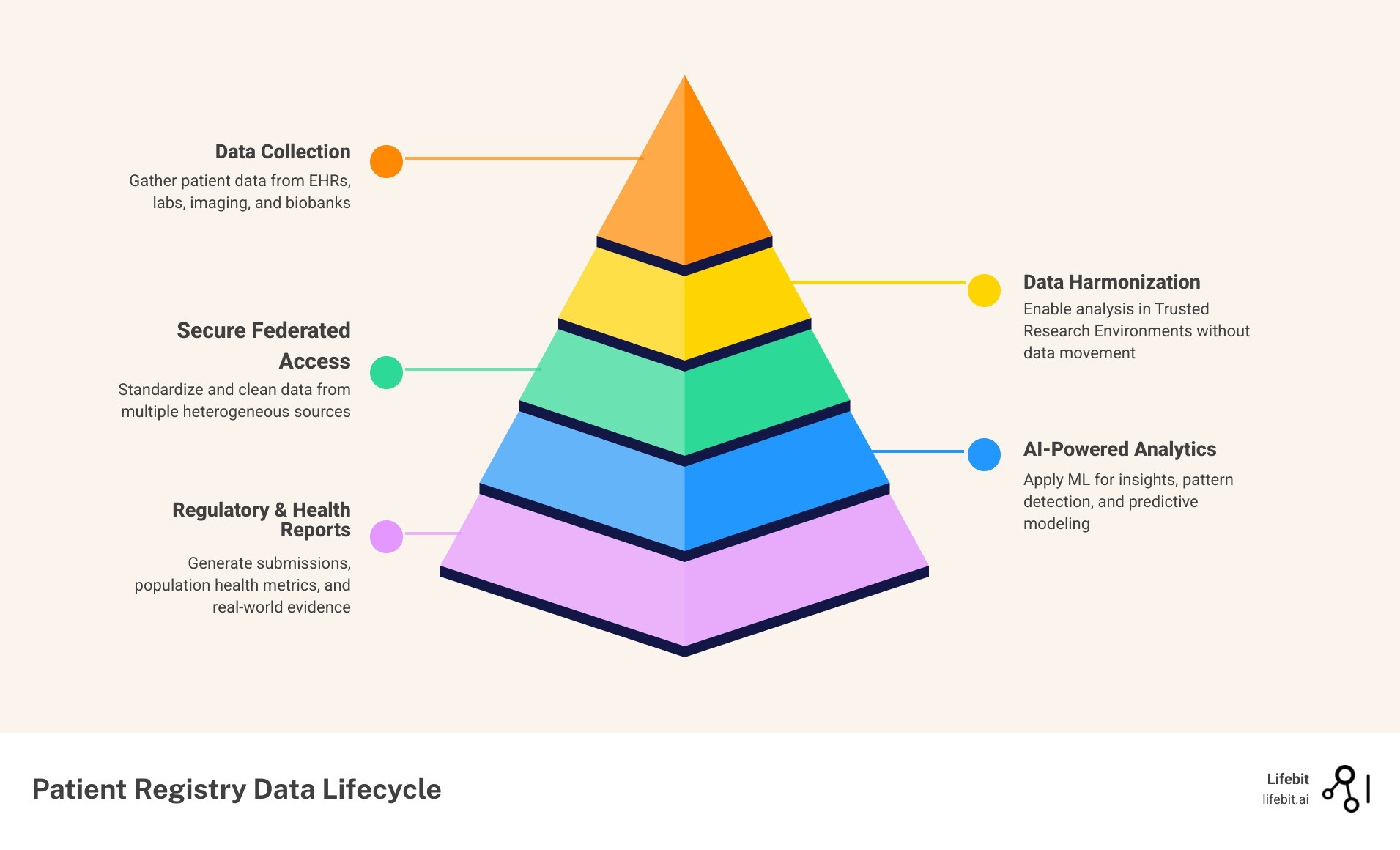

The Rise of Federated Learning and TREs

At Lifebit, we believe the future lies in federated learning. Instead of moving sensitive patient data to a central server (where it is vulnerable and often violates data sovereignty laws), our platform brings the analysis to the data. This “data-stays-put” approach is the gold standard for satisfying strict GDPR (Europe) and HIPAA (USA) requirements.

When evaluating four key patient registry software requirements, security and compliance are at the top of the list. Advanced patient registry software now includes features like:

- Trusted Research Environments (TREs): Secure spaces where researchers can analyze data without being able to download or remove the raw records.

- Airlocks: A rigorous review process where any output (like a graph or a table) is checked for privacy risks before it can be exported from the system.

- De-identification Engines: Automated tools that strip away Personal Health Information (PHI) while maintaining the clinical utility of the data.

- Blockchain for Consent: Using distributed ledger technology to track patient consent in real-time, ensuring that data is only used for the purposes the patient agreed to.

By solving the privacy puzzle, the global patient registry software market is unlocking data that was previously trapped in hospital silos, enabling a new era of global collaborative research.

Global Patient Registry Software Market: Why Asia Pacific Hits 10% CAGR

The global patient registry software market doesn’t look the same everywhere. North America remains the dominant force, currently holding nearly 49% of the market. This is largely due to a mature healthcare IT ecosystem, high EHR adoption rates, and a regulatory environment that actively encourages the use of real-world evidence. In the U.S., initiatives like the 21st Century Cures Act and the FDA’s Sentinel Initiative have made real-world evidence a requirement, not a luxury.

Global Patient Registry Software Market: Why Asia is Investing Billions

However, the center of gravity is shifting. China and India are undergoing a digital health revolution. With massive patient populations, these countries are investing billions into national digital health programs. The need for structured data to manage public health is driving a CAGR of over 10% in this region.

In China, the “Healthy China 2030” initiative is prioritizing the creation of national registries for chronic diseases and cancer. Similarly, India’s Ayushman Bharat Digital Mission aims to create a seamless digital health ecosystem where patient data can follow the individual across different providers. This requires sophisticated hospital registry systems that can track infectious diseases and chronic conditions across millions of citizens. The sheer volume of data generated in these regions makes them a goldmine for pharmaceutical research, provided the software can handle the scale.

Europe and the European Health Data Space (EHDS)

Europe is also a key player, with a focus on cross-border data sharing. The European Health Data Space (EHDS) is a landmark initiative designed to allow patients to share their health data with healthcare providers and researchers across the EU. This initiative is a massive driver for the global patient registry software market in Europe, as it mandates the use of standardized formats and secure access protocols.

Scale Securely with Federated Access

As these regional registries grow, the next challenge is connecting them. This is where federated access becomes a game-changer. By using a clinical registry solutions guide, organizations can learn how to implement governance models that allow for secure collaboration. Our work at Lifebit focuses on this exact problem: enabling a researcher in London to securely analyze data from a registry in Singapore without the data ever leaving its home jurisdiction. This global connectivity is what will ultimately drive the market toward that $6.78 billion valuation.

Global Patient Registry Software Market: Kill Data Silos with FHIR Standards

Despite the “boom,” the global patient registry software market faces a significant hurdle: data silos. Many registries still operate in isolation, using different formats, terminologies, and standards. This makes it incredibly difficult to get a “big picture” view of patient health or to conduct meta-analyses across multiple registries.

To fix this, the industry is rallying around FHIR (Fast Healthcare Interoperability Resources) standards. Developed by HL7, FHIR acts as a universal translator, allowing different software systems to speak the same language. It uses modern web technologies (RESTful APIs) to make data exchange as simple as browsing the internet.

Common challenges that FHIR and modern software aim to solve include:

- Legacy Systems: Many older hospitals still use outdated software that doesn’t play well with others. Modern registry software must include “wrappers” or ETL (Extract, Transform, Load) tools to pull data from these legacy systems into a standardized format.

- Data Quality and Semantic Interoperability: It’s not enough for two systems to exchange data; they must also agree on what the data means. For example, one system might code a diagnosis using ICD-10, while another uses SNOMED-CT. Advanced registry software uses semantic mapping to ensure that “Type 2 Diabetes” means the same thing across all datasets.

- Patient Consent Management: Managing consent for data reuse across multiple studies is a complex legal minefield. Modern platforms are incorporating “Dynamic Consent,” where patients can update their preferences via a mobile app, and the registry software automatically adjusts data access permissions accordingly.

- The “Data Tax”: The manual effort required to extract data from EHRs and enter it into registries is often referred to as a “data tax” on clinicians. Automation through integrated software is the only way to eliminate this burden and ensure high-quality, real-time data collection.

As noted in the FDA facts on postmarket patient registries, registries are vital for ensuring device safety, but they only work if the data is accessible and standardized. You can read more about the challenges facing patient registries in the us to understand how these interoperability gaps are being closed through policy and better software design. The goal is a “plug-and-play” ecosystem where a new registry can be stood up in days, not months, by leveraging existing data streams.

Global Patient Registry Software Market: 5 Critical Growth Facts

1. What is the projected size of the global patient registry software market?

The global patient registry software market is expected to reach $6.78 billion by 2035. This growth is driven by an 11.04% CAGR, fueled by the rising prevalence of chronic diseases, the global shift toward digital healthcare infrastructure, and the increasing demand for real-world evidence in drug development.

2. Which registry type dominates the market and why?

Disease registries are currently the dominant segment, holding over 52% of the market. This is because they are essential for managing high-cost, high-prevalence conditions like diabetes, cancer, and cardiovascular health. Additionally, the rare diseases registry complete guide highlights how specialized registries are becoming crucial for orphan drug development, where traditional clinical trials are often impossible due to small patient numbers.

3. How does cloud deployment impact market adoption?

Cloud deployment is accelerating market adoption by offering subscription models (SaaS). This reduces the need for massive upfront capital investment (CapEx) and eliminates the burden of maintaining on-site IT staff, making high-end registry software accessible to smaller hospitals, non-profits, and research centers. It also facilitates easier multi-center collaboration, which is essential for large-scale epidemiological studies.

4. What role does AI play in modern registry software?

AI is used for automated data abstraction, cleaning, and predictive analytics. For example, Natural Language Processing (NLP) can scan unstructured clinician notes in an EHR to extract relevant data points for a registry, such as a patient’s smoking status or specific symptoms, which would otherwise require manual entry.

5. Why is the Asia-Pacific region growing so quickly?

Asia-Pacific is seeing a CAGR of over 10% due to massive government investments in digital health infrastructure in China and India. These nations are leapfrogging older technologies and moving straight to cloud-native, mobile-integrated registry systems to manage their vast populations and address the growing burden of non-communicable diseases.

Global Patient Registry Software Market: Join the Data-Driven Future

The global patient registry software market is no longer a niche sector of healthcare IT—it is the engine driving the future of medicine. From tracking the long-term safety of medical devices to accelerating the discovery of cures for rare diseases, these software platforms provide the real-world evidence that randomized trials simply cannot match.

As we look toward 2035, the integration of multi-omic data (genomics, proteomics, etc.) into patient registries will be the next great frontier. This will allow for true “Precision Medicine,” where treatments are tailored not just to a disease, but to an individual’s unique genetic makeup and real-world environment. The software that can securely manage and analyze this complex data will be the most valuable asset in the healthcare ecosystem.

At Lifebit, we are proud to be at the forefront of this change. Our federated AI platform is designed to break down data silos while maintaining the highest levels of security and compliance. By enabling secure, real-time access to global multi-omic data, we are helping biopharma and government agencies turn fragmented data into life-saving insights. We are moving away from a world of isolated data islands toward a connected global network of health insights.

The boom is here, and the technology to handle it is finally ready. The transition to a data-driven healthcare system is inevitable, and those who embrace the power of advanced registry software will be the leaders of the next generation of medicine. Advance your research with Lifebit’s federated platform and join the movement toward a more connected, data-driven healthcare future.