Your Medicare Adventure Awaits: Discover Coverage Choices

Medicare: 2025 Ultimate Guide

Understanding Medicare: Your Gateway to Healthcare Security

Medicare is America’s federal health insurance program that provides coverage for 65 million people – including those 65 and older, younger individuals with disabilities, and people with End-Stage Renal Disease. If you’re exploring Medicare coverage options, here’s what you need to know:

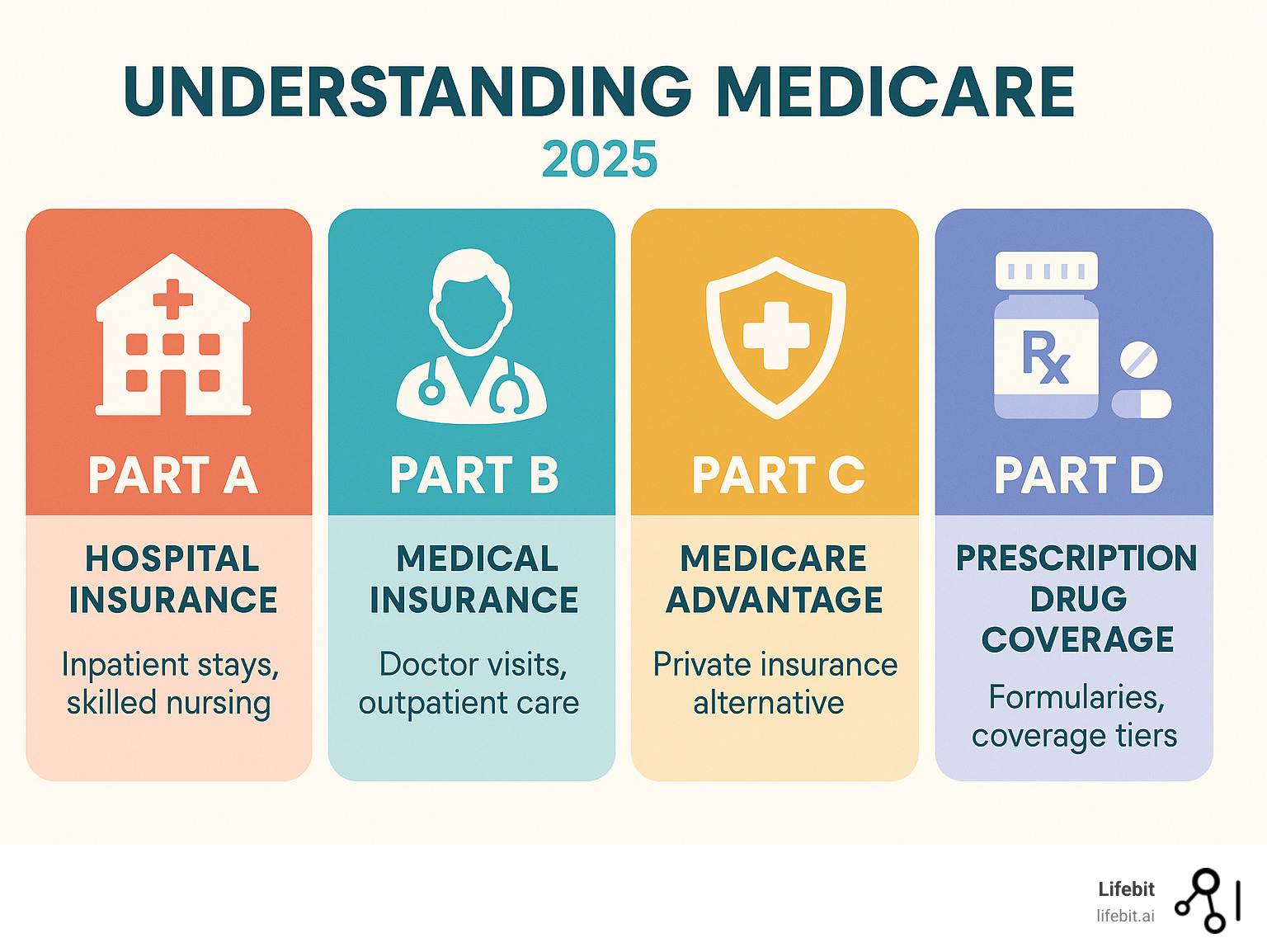

Quick Medicare Overview:

- Part A – Hospital insurance (inpatient care, skilled nursing)

- Part B – Medical insurance (doctor visits, outpatient services)

- Part C – Medicare Advantage (private plans combining A+B+often D)

- Part D – Prescription drug coverage

Medicare spending topped $900 billion in 2022, representing nearly 4% of U.S. GDP and serving as a critical safety net for millions of Americans. The program operates through a complex system of federal standards, private insurance options, and coordinated benefits that can seem overwhelming at first glance.

Understanding your Medicare options becomes crucial as you approach eligibility or face changing health needs. The choices you make during enrollment periods can significantly impact your healthcare costs and access to providers for years to come.

About the Author: I’m Maria Chatzou Dunford, CEO of Lifebit, where we work with public sector institutions to analyze large-scale healthcare datasets that inform Medicare policy and outcomes research. My background in computational biology and health-tech helps me understand how Medicare data drives better healthcare decisions across federated, secure environments.

Medicare terms to know:

What is Medicare and Who Qualifies?

Picture this: you’re approaching your 65th birthday, and suddenly everyone’s talking about Medicare. Maybe you’re feeling a bit overwhelmed by all the acronyms and enrollment dates flying around. Don’t worry – you’re definitely not alone in this.

Medicare is essentially America’s promise to provide healthcare security for our seniors and those who need it most. This federal health insurance program currently serves about 65 million people, which is pretty incredible when you think about it. That’s roughly one in five Americans who rely on Medicare for their healthcare coverage.

But here’s the thing – Medicare isn’t just for people celebrating their 65th birthday. While that’s the most common path to eligibility, there are actually several ways you might qualify for this vital program.

If you’re 65 or older, you’re likely eligible for Medicare as long as you’re a U.S. citizen or have been a legal permanent resident for at least five continuous years. The best part? If you or your spouse worked and paid Medicare taxes for at least 10 years, you won’t pay a premium for Part A hospital coverage.

Younger folks with disabilities can also access Medicare. If you’ve been receiving Social Security Disability Insurance benefits for 24 months, you generally become eligible for Medicare coverage. It’s one way the program ensures that age doesn’t determine your access to essential healthcare.

There are also some specific medical conditions that open the door to Medicare regardless of age. End-Stage Renal Disease – basically permanent kidney failure requiring dialysis or a transplant – makes you eligible after a waiting period. And if you’re diagnosed with ALS (Lou Gehrig’s Disease), you can access Medicare immediately without any waiting period at all.

For the most up-to-date details on who qualifies, the government has put together a comprehensive guide: Who is eligible for Medicare?.

Once you’re eligible, the real adventure begins – choosing how you want to receive your Medicare benefits. Think of it like choosing between different flavors of ice cream, except this decision affects your healthcare for years to come.

Original Medicare (Parts A & B)

Original Medicare is like the classic vanilla – it’s been around since the beginning and forms the foundation of the entire program. This is the government-administered, fee-for-service model that most people think of when they hear “Medicare.”

With Original Medicare, you get the freedom to see virtually any doctor or visit any hospital in the United States that accepts Medicare. No networks to worry about, no referrals needed – just straightforward healthcare coverage where the government pays providers directly for the services you receive.

The enrollment process is pretty straightforward too. You’ll typically sign up through the Social Security Administration, and they’ll walk you through getting both Part A and Part B coverage. If you want all the nitty-gritty details about eligibility and enrollment, check out this official resource: Original Medicare (Part A and B) Eligibility and Enrollment | CMS.

Medicare Advantage (Part C)

Now, if Original Medicare is vanilla, then Medicare Advantage is like those fancy gelato shops with dozens of flavors and mix-ins. These plans are offered by private insurance companies that have gotten the government’s stamp of approval.

When you choose a Medicare Advantage plan, you’re still getting your Part A and Part B benefits – they’re just delivered through a private company instead of directly from the government. It’s like having Medicare with a personal touch.

The really appealing part? Many Medicare Advantage plans bundle in extras that Original Medicare doesn’t cover. We’re talking about things like routine vision care, dental coverage, and hearing services. Many plans also throw in prescription drug coverage, creating a convenient all-in-one healthcare package.

But here’s the trade-off – these plans usually work more like the employer insurance you might be familiar with, with network restrictions. You’ll likely need to stick with doctors and hospitals in the plan’s network, and you might need referrals to see specialists.

Prescription Drug Plans (Part D)

Let’s be honest – prescription costs can be scary. That’s exactly why Medicare Part D exists, and it’s been a game-changer since it was added to the program.

If you stick with Original Medicare, you can add a standalone prescription drug plan from a private insurance company. These plans work alongside your existing coverage to help manage those medication costs that can really add up.

Each plan has what’s called a formulary – basically a list of covered medications. Different plans cover different drugs, so it’s worth doing some homework to make sure your specific medications are on the list.

One thing you’ll hear people talk about is the coverage gap, or “donut hole.” This used to be a real problem where people faced higher costs after reaching a certain spending threshold. The good news is that recent changes have been steadily closing this gap, making prescription coverage much more predictable and affordable.

If you go with a Medicare Advantage plan, there’s a good chance your prescription coverage is already built right in, which can make managing everything much simpler.

Decoding the Alphabet Soup: The Four Parts of Medicare

Understanding the different parts of Medicare can feel like learning a new language, but we’re here to help translate! Each part plays a distinct role in covering various healthcare services, and knowing what each one does will help you make informed decisions about your coverage.

Think of Medicare as a four-piece puzzle. Each piece covers different aspects of your healthcare needs, and you can mix and match them depending on what works best for your situation.

| Medicare Part | What it Covers | How it Works & Key Costs (2024) | Provider Choice |

|---|---|---|---|

| Part A | Hospital stays, skilled nursing, hospice, home health | Usually premium-free; $1,632 hospital deductible | Any Medicare-approved provider |

| Part B | Doctor visits, outpatient care, medical supplies, preventive services | $174.70 monthly premium; $240 deductible; 80/20 coinsurance | Any Medicare-approved provider |

| Part C | All Part A & B services plus often Part D; may include vision, dental | Varies by plan; out-of-pocket maximums apply | Network restrictions (HMO/PPO) |

| Part D | Prescription drugs | Varies by plan; formulary-based coverage; donut hole applies | Network pharmacies |

Part A: Hospital Insurance

Part A is like your safety net for serious medical situations. It covers inpatient hospital stays, which means if you need to be admitted to the hospital overnight, Part A steps in to help with those costs. But it doesn’t stop there.

This part of Medicare also covers skilled nursing facility care when you need rehabilitation or specialized care after a hospital stay. It’s important to know that this isn’t the same as long-term custodial care – Part A focuses on skilled medical services that help you recover.

Hospice care and home health care are also included under Part A. These services recognize that sometimes the best care happens in the comfort of your own home or in a specialized setting focused on comfort and quality of life.

Here’s where it gets a bit technical: Part A works on benefit periods. Each benefit period starts when you’re admitted to a hospital and ends when you haven’t received inpatient care for 60 days in a row. In 2024, you’ll pay a $1,632 hospital deductible for each benefit period. Part A also has something called lifetime reserve days – these are extra days you can use if you need extended hospital care.

The good news? Most people don’t pay a monthly premium for Part A because they or their spouse paid Medicare taxes while working.

Part B: Medical Insurance

Part B handles the everyday healthcare services that keep you healthy and active. This includes doctor’s services – those regular check-ups, specialist visits, and consultations that are part of maintaining your health.

Outpatient care is a big part of what Part B covers. This includes things like lab tests, X-rays, and procedures that don’t require an overnight hospital stay. It also covers medical supplies like wheelchairs, walkers, and other durable medical equipment you might need.

One of the most valuable aspects of Part B is its coverage of preventive services. Annual wellness visits, screenings for cancer and other conditions, and vaccines are often covered at no cost to you – because preventing health problems is always better than treating them later.

For 2024, the standard monthly premium is $174.70, though you might pay more if you have higher income. You’ll also have a $240 annual deductible to meet. After that, Medicare typically pays 80% of approved costs while you pay the remaining 20% – this is called 80/20 coinsurance.

Part C: Medicare Advantage

Part C, also known as Medicare Advantage, is like getting all your Medicare benefits wrapped up in one package from a private insurance company. These companies contract with Medicare to provide all your Part A and Part B benefits, and often much more.

Most Medicare Advantage plans combine Part A and B coverage and often include Part D prescription drug coverage too. Many go even further, offering benefits that Original Medicare doesn’t cover, like routine vision, dental, and hearing services.

These plans come in familiar formats – HMOs and PPOs – which means you’ll typically need to use doctors and hospitals within the plan’s network. The trade-off is that Medicare Advantage plans have out-of-pocket maximums, which can provide financial protection that Original Medicare doesn’t offer.

Part D: Prescription Drug Coverage

Part D was added to Medicare through the Medicare Modernization Act, recognizing that prescription medications are a crucial part of modern healthcare. This coverage helps make your medications more affordable.

Each Part D plan has a drug formulary – essentially a list of covered medications organized into different tiers. Generally, generic drugs are in lower tiers with lower costs, while brand-name and specialty drugs are in higher tiers with higher costs.

You’ve probably heard about the donut hole – officially called the coverage gap. This happens when your total drug costs reach a certain amount, and you temporarily pay more for your medications until you reach catastrophic coverage levels. The good news is that the donut hole has been shrinking over the years, making medications more affordable even during this coverage gap.

Whether you get Part D through a standalone plan or as part of a Medicare Advantage plan, having prescription drug coverage can provide significant peace of mind and savings on the medications you need.