An Essential Guide to Federal Health Programs

Stop Overpaying: Cut Your Federal Health Costs by Thousands This Open Season

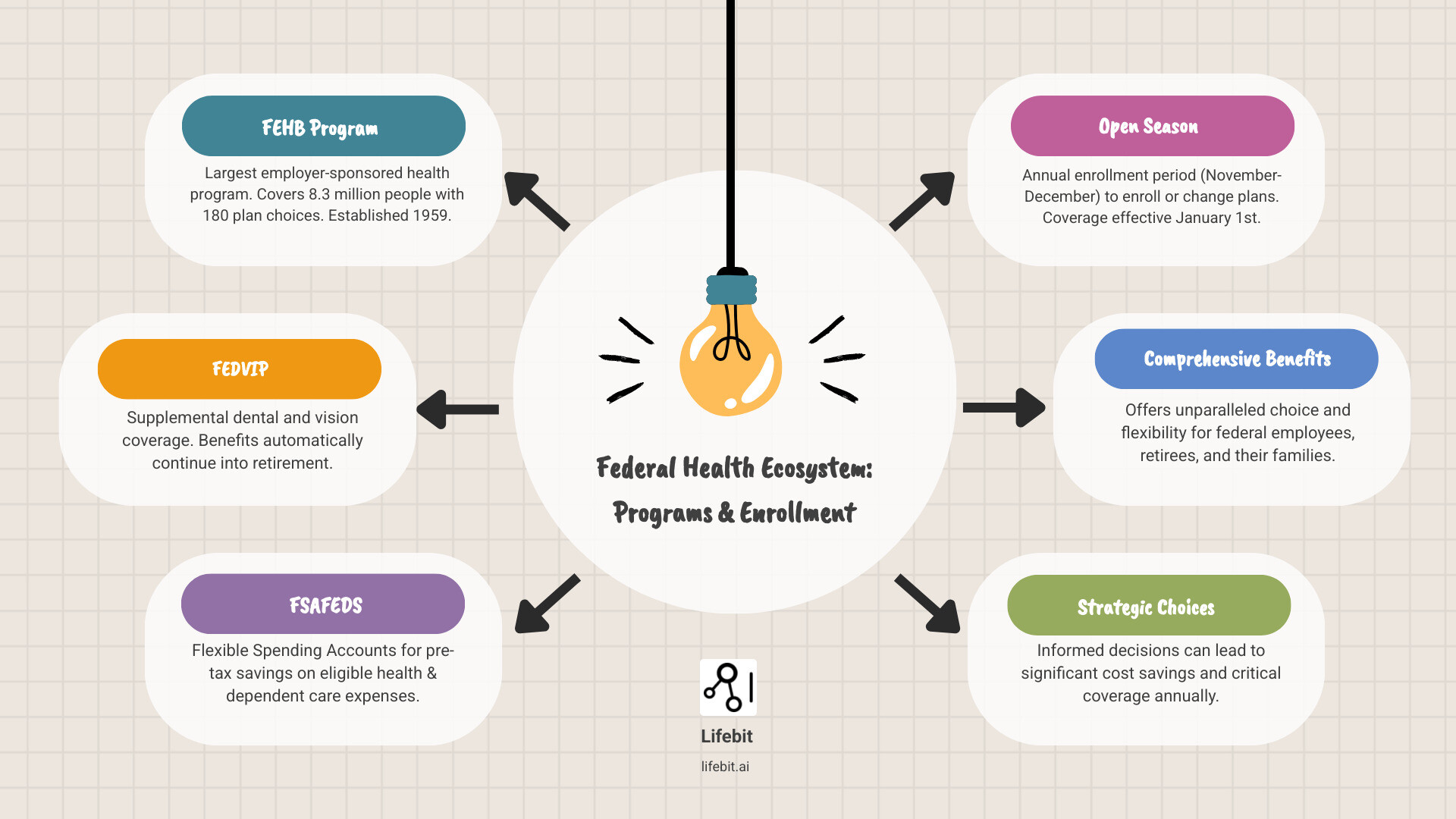

Federal Health benefits are a critical lifeline for millions of federal employees, retirees, and their families. Understanding this system is key to saving thousands of dollars annually and securing the best care. The cornerstone is the Federal Employees Health Benefits (FEHB) Program, the nation’s largest employer-sponsored health plan, serving 8.3 million people with over 180 plan choices.

Key programs you need to know:

- FEHB: Your primary health insurance.

- FEDVIP: Supplemental dental and vision coverage.

- FSAFEDS: Pre-tax flexible spending accounts for health and dependent care.

- Open Season: The annual period (Nov-Dec) to enroll or change plans.

Beyond employee benefits, the Federal Health landscape, led by the Department of Health and Human Services (HHS), generates vast amounts of data. As Dr. Maria Chatzou Dunford, CEO of Lifebit, notes, “Securely analyzing this data is the key to revolutionizing everything from drug findy to public health outcomes. We help federal agencies open up that potential.”

Quick Federal Health definitions:

- All of Us

- Cancer Moonshot

- Veterans Affairs

The 5 Federal Health Agencies That Drive Your Costs and Safety—Use Their Data Today

The U.S. Federal Health ecosystem is a complex network that impacts nearly every American. At its center is the U.S. Department of Health and Human Services (HHS), the government’s principal agency for protecting public health and providing essential human services. Its mission is to improve the health and well-being of all Americans by fostering advances in medicine, public health, and social services. You can explore HHS initiatives at the official U.S. Department of Health and Human Services Website.

Key HHS Agencies and Their Roles

HHS operates through several powerful agencies, each with a distinct role in the Federal Health landscape:

- Food and Drug Administration (FDA): As America’s safety gatekeeper, the FDA is responsible for ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical devices. It also oversees the safety of our nation’s food supply, cosmetics, and products that emit radiation. The FDA’s drug approval process is a rigorous, multi-phase system (Phase I, II, and III clinical trials) designed to assess safety and effectiveness before a product reaches the public, with post-market monitoring (Phase IV) to track long-term safety.

- National Institutes of Health (NIH): The NIH is the world’s foremost medical research agency and the primary federal entity for conducting and funding medical research. Comprising 27 distinct institutes and centers, each with a specific research agenda (such as the National Cancer Institute or the National Institute of Allergy and Infectious Diseases), the NIH invests billions of dollars annually in research at universities, medical schools, and other institutions across the country and around the globe. This funding has led to countless discoveries that have improved health and saved lives, from developing vaccines to understanding the genetic basis of disease.

- Centers for Disease Control and Prevention (CDC): The nation’s leading public health institute, the CDC works 24/7 to protect America from health, safety, and security threats, both foreign and domestic. The CDC fights disease and supports communities by conducting critical science and providing health information. Its experts detect and respond to new and emerging health threats, use data to make public health action more effective, and tackle the biggest health problems causing death and disability for Americans.

- Centers for Medicare & Medicaid Services (CMS): A powerhouse in the healthcare system, CMS manages health insurance for over 150 million Americans through Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and the Health Insurance Marketplace. Medicare provides health coverage for people 65 or older and younger people with certain disabilities, and it is broken into different parts: Part A (Hospital Insurance), Part B (Medical Insurance), Part C (Medicare Advantage), and Part D (Prescription Drug Coverage). Medicaid is a joint federal and state program that provides health coverage to millions of low-income adults, children, pregnant women, elderly adults, and people with disabilities. Because of its massive scale, CMS’s policies on reimbursement and quality have a profound influence on the entire U.S. healthcare industry.

- Agency for Healthcare Research and Quality (AHRQ): AHRQ’s mission is to produce evidence to make health care safer, higher quality, more accessible, equitable, and affordable. While the NIH focuses on discovering new treatments, AHRQ focuses on how to make the best use of the treatments we already have. It generates research and toolkits that are used by doctors, nurses, and hospital administrators to improve patient safety, reduce medical errors, and enhance the quality of care delivered to patients.

These agencies generate enormous amounts of health data. When this data is securely analyzed, it can accelerate drug discovery, improve patient outcomes, and identify safety signals faster. Modern federated data platforms enable this collaboration across vast Federal Health data ecosystems without compromising patient privacy.

FEHB in 15 Minutes: Choose the Right Plan and Avoid Costly Traps

The Federal Employees Health Benefits (FEHB) Program is the crown jewel of Federal Health benefits and the largest employer-sponsored health program in the United States. Launched in 1960, it now covers nearly 8.3 million federal employees, retirees, and their dependents.

What makes FEHB exceptional is its choice: federal employees can select from approximately 180 different health plan choices, ensuring a fit for every family’s needs and budget. For comprehensive guidance, visit the Office of Personnel Management (OPM) at Healthcare information from OPM.

Who is Eligible for FEHB?

FEHB eligibility is broad, extending beyond the employee to cover their family. Key eligible groups include:

- Federal employees: Most active, full-time and part-time civilian employees are eligible. Eligibility for temporary, seasonal, and intermittent employees depends on specific work schedule and appointment criteria.

- Federal retirees: Retirees can carry their FEHB coverage into retirement if they meet two key criteria, often called the “5-year rule”: they must be entitled to an immediate annuity and have been continuously enrolled in any FEHB plan for the five years of service immediately preceding their retirement.

- Eligible survivors: Spouses and dependents of deceased federal employees or retirees who were enrolled in a Self and Family plan at the time of death may be eligible to continue FEHB coverage.

- Family members: Spouses and children under age 26 are covered. This includes legally married spouses, adopted children, stepchildren, and foster children under specific conditions. A child aged 26 or over who is incapable of self-support due to a mental or physical disability that existed before age 26 also remains eligible.

- Former Spouses: Under the Civil Service Retirement Spouse Equity Act, certain former spouses of federal employees may be eligible to enroll in FEHB, though they are typically responsible for the full premium cost.

For complete eligibility details, consult the FEHB Eligibility Details.

Comparing FEHB Plan Types

FEHB plans offer fundamentally different approaches to care and cost. Understanding them is the first step to making a smart choice.

- Health Maintenance Organizations (HMOs): These plans require you to use doctors, hospitals, and specialists within their network and to select a Primary Care Physician (PCP). This PCP acts as a “gatekeeper,” meaning you need a referral from them to see a specialist. In exchange for less provider choice, you typically get lower premiums, no deductibles, and predictable copayments for services.

- Preferred Provider Organizations (PPOs): PPOs offer the most flexibility. You can see any doctor or specialist you choose without a referral, both in- and out-of-network. However, your costs will be significantly lower if you use providers within the plan’s “preferred” network. Out-of-network care is still covered but at a higher cost, often involving higher deductibles and coinsurance.

- Consumer-Driven and High Deductible Health Plans (CDHPs/HDHPs): These plans combine a high-deductible health plan with a tax-advantaged savings account. The lower premiums are a major draw. The high deductible means you pay more for your care upfront, but the plan protects you from catastrophic costs. These plans are paired with either a Health Savings Account (HSA) or a Health Reimbursement Arrangement (HRA).

- Health Savings Account (HSA): An HSA is a powerful financial tool with a triple-tax advantage: 1) contributions are tax-deductible, 2) the money grows tax-free, and 3) withdrawals for qualified medical expenses are tax-free. You own the account, and the funds roll over year after year, making it an excellent vehicle for both healthcare costs and retirement savings.

- Health Reimbursement Arrangement (HRA): An HRA is an employer-funded account that provides a set amount of money each year to help you pay for medical expenses. Unlike an HSA, the employer owns the account, and the funds may not roll over if you leave the job.

| Plan Type | Key Features | Provider Choice | Referrals Needed | Out-of-Pocket Costs | Best For |

|---|---|---|---|---|---|

| HMO | Coordinated care, emphasis on prevention | Limited to network | Yes, for specialists | Generally lower | Those who prefer lower premiums and don’t mind a PCP coordinating care |

| PPO | Flexibility, no referrals needed for specialists | In-network savings, out-of-network options | No | Moderate to higher, depending on network use | Those who want more choice in providers and don’t mind higher premiums for flexibility |

| FFS | Traditional insurance, pay for services as you get them | Often combined with PPO networks | No | Can vary widely, often higher for out-of-network | Similar to PPO, often less common as standalone |

| HDHP/CDHP | High deductible, often paired with HSA/HRA | Wide choice, typically lower premiums | No | Higher deductible, but potential for tax-advantaged savings | Those who want lower premiums, are healthy, and want to save for future medical expenses |

How to Choose the Right FEHB Plan

Choosing from 180 options can be daunting. Focus on what matters most:

- Look at total cost, not just premiums. Total cost includes your annual premiums plus your expected out-of-pocket expenses (deductibles, copays, and coinsurance) up to the plan’s out-of-pocket maximum. A low-premium plan could cost you more if it has a high deductible and you anticipate needing significant medical care. Always calculate your worst-case scenario by adding the annual premiums to the out-of-pocket maximum.

- Assess your health needs. Review your family’s health history from the past year. Do you have a chronic condition like diabetes or asthma? Do you anticipate a major medical event like a surgery or the birth of a child? Choose a plan that provides strong coverage for your specific needs.

- Check the provider network. If you have doctors you love, make sure they are in the plan’s network before you enroll. This is especially critical for HMOs. For PPOs, check the cost difference between seeing your preferred doctor in-network versus out-of-network. Don’t forget to check for hospitals, urgent care centers, and mental health providers.

- Leverage prescription savings. All plans have a prescription drug formulary—a list of covered drugs. Check this list to ensure your specific medications are covered and at what cost tier. Generic drugs are cheapest, followed by preferred brand-name drugs, and then non-preferred brand-name drugs. Also, remember that FEHB members are exempt from the Anti-Kickback Act and can use pharmacy incentive programs and manufacturer co-pay cards to significantly reduce medication costs. Ask your pharmacist or search online for these savings.

Don’t Leave Money on the Table: Use FEDVIP and FSAFEDS to Slash Out-of-Pocket Costs

Beyond your primary FEHB plan, two key programs help you cover additional expenses and save money: the Federal Employees Dental and Vision Insurance Program (FEDVIP) and Flexible Spending Accounts (FSAFEDS). These programs are optional but offer significant financial advantages.

Federal Employees Dental and Vision Insurance Program (FEDVIP)

FEDVIP provides comprehensive dental and vision coverage to supplement your Federal Health benefits. Your FEHB plan may offer some limited dental or vision benefits, but FEDVIP offers more robust, standalone insurance.

- How it Works: FEDVIP operates on an enrollee-pay-all basis, meaning there is no government contribution to the premiums. However, for active employees, premiums are paid with pre-tax dollars, which lowers your overall taxable income and saves you money.

- Eligibility and Enrollment: Eligibility is broad and includes most federal employees, retirees, and their family members. Crucially, you do not need to be enrolled in FEHB to sign up for FEDVIP.

- Plan Choices: You can choose from multiple national and regional carriers (such as Aetna, MetLife, and United Concordia for dental; VSP and FEP BlueVision for vision). Most carriers offer a Standard Option and a High Option plan, allowing you to balance premium cost with coverage levels. High Option plans typically have higher premiums but lower cost-sharing and higher maximum benefit amounts.

- Coverage in Retirement: One of FEDVIP’s most valuable features is that your coverage automatically continues into retirement. As long as you are enrolled as an employee, you do not need to do anything to maintain coverage. Premiums will be automatically deducted from your annuity, ensuring you don’t lose this critical coverage when you stop working.

Flexible Spending Accounts (FSAFEDS)

FSAFEDS is one of the smartest ways to manage out-of-pocket healthcare and dependent care costs. These accounts let you set aside money from your paycheck before taxes to pay for eligible expenses. This reduces your taxable income, saving you an estimated 30% on every dollar you contribute, depending on your tax bracket.

- Health Care FSA (HCFSA): This account is for out-of-pocket medical, dental, and vision costs not covered by your insurance. You can use it for deductibles, copayments, and coinsurance. It also covers a vast array of other expenses, including:

- Dental: Braces, implants, and non-cosmetic procedures.

- Vision: Glasses, contact lenses, prescription sunglasses, and LASIK surgery.

- Medical Equipment: Blood pressure monitors, crutches, and hearing aids.

- Over-the-Counter (OTC): As of 2020, you can use your HCFSA for OTC medicines like pain relievers and cold medicine, as well as menstrual care products, without a prescription.

- The “Use-It-or-Lose-It” Rule: You must use the funds in your HCFSA by the end of the plan year. However, FSAFEDS has a carryover provision that allows you to bring a certain amount (check FSAFEDS.com for the current year’s limit) of unspent funds into the next year, reducing the risk of forfeiture.

- Dependent Care FSA (DCFSA): This account is used to pay for the care of a child under 13 or a disabled dependent of any age, allowing you (and your spouse) to work or look for work. Eligible expenses include:

- Daycare, preschool, and nursery school fees.

- Before- and after-school programs.

- Summer day camps (overnight camps are not eligible).

- Nanny or au pair services (for care, not household chores).

- The annual contribution limit is set by the IRS (typically $5,000 per household).

Both accounts are powerful tools in your Federal Health benefits package that help you plan for expenses and keep more of your hard-earned money.

Open Season Starts Nov 10: Lock In 2025 Coverage Now or Pay More Later

Knowing when and how to manage your Federal Health benefits is crucial. The system runs on a strict timeline, so understanding key dates and the rules for making changes is essential to maximizing your benefits and avoiding costly mistakes.

The Federal Benefits Open Season

Every year from the Monday of the second full week in November to the Monday of the second full week in December, the Federal Benefits Open Season is your one guaranteed chance to make changes to your coverage. The 2025 Federal Benefits Open Season begins November 10. During this period, you can:

- Enroll in an FEHB, FEDVIP, or FSAFEDS plan.

- Change your current plan or options (e.g., switch from a PPO to an HDHP, or from Self Only to Self and Family coverage).

- Cancel your enrollment in a plan.

Changes made during Open Season become effective on the first day of the first full pay period in January of the following year. If you are happy with your current FEHB and FEDVIP plans, your coverage will automatically continue. However, you must re-enroll in FSAFEDS each year to continue participating.

Qualifying Life Events (QLEs)

Outside of Open Season, you can only make changes to your FEHB or FEDVIP enrollment if you experience a Qualifying Life Event (QLE). A QLE is a change in your personal life that allows you to make benefit changes consistent with that event. Common QLEs include:

- Marriage or divorce.

- Birth or adoption of a child.

- Death of a spouse or dependent.

- A change in your employment status (e.g., moving from part-time to full-time).

- A change in your dependent’s eligibility (e.g., your child turns 26).

- A significant change in your spouse’s health coverage.

You typically have 31 days before or 60 days after the event to make a change. The change you make must be related to the event; for example, after getting married, you can change from a Self Only to a Self and Family plan, but you cannot switch from an HMO to a PPO.

Understanding Your Federal Health Coverage During a Government Shutdown

Rest assured: your Federal Health coverage continues without interruption during a government shutdown. Both your FEHB and FEDVIP plans remain active, so you can continue to use your benefits as usual. While your paycheck may be delayed, agencies have procedures to handle premium payments, which are reconciled once pay resumes. Your coverage is secure.

Alternatives: The Health Insurance Marketplace

If you don’t qualify for federal employee benefits—perhaps you’re a contractor, a former employee who is not retired, or a family member who has aged out of coverage—the Health Insurance Marketplace is an important alternative. Created by the Affordable Care Act (ACA), the Marketplace helps individuals and families find affordable health coverage.

Plans are categorized into four “metal tiers”: Bronze, Silver, Gold, and Platinum. Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs, while Platinum plans have the highest premiums and lowest costs. Depending on your income, you may qualify for two types of savings:

- Premium Tax Credits: Subsidies that lower your monthly insurance premium.

- Cost-Sharing Reductions: Extra savings that lower your deductible, copayments, and out-of-pocket maximum (only available on Silver plans).

You can compare plans and check for savings at HealthCare.gov. The annual Open Enrollment period for the Marketplace typically runs from November 1st to January 15th.

Stop Guessing: Use OPM’s Public Data to Compare Plans and Avoid Overpaying

Beyond the basics, two key elements ensure your Federal Health benefits program runs effectively: data transparency and strict carrier standards.

Data and Transparency: Public Use Files (PUF)

OPM promotes transparency by publishing Public Use Files (PUF) for both FEHB and FEDVIP. These files are like nutrition labels for health insurance, offering detailed data on benefits, rates, and coverage limitations. They empower you to look past marketing and make truly informed decisions by comparing the fine print of different plans. This commitment to data transparency mirrors the principles behind modern data platforms that enable better healthcare decisions at scale.

Guiding Principles for Federal Health Insurance Carriers

To participate in the FEHB Program, insurance carriers must adhere to ten guiding principles set by OPM. These standards ensure the program remains high-quality and reliable. Key principles demand that carriers provide:

- Access and Affordability: Good benefits at a reasonable cost.

- Quality and Choice: High-quality provider networks and competitive plan options.

- Consumer Empowerment: Clear information to help you make smart decisions.

- Financial and Operational Integrity: Carriers must be well-managed, financially secure, and compliant with all rules, protecting enrollees and taxpayer resources from waste, fraud, and abuse.

These principles are the backbone of the FEHB program’s success. You can learn more at FEHB Carrier Information.

Federal Health FAQs: Fast Answers That Save You Money

Here are straightforward answers to the most common questions about Federal Health benefits.

What are the key dates for the next Open Season?

Mark your calendar: The 2025 Federal Benefits Open Season begins November 10. This annual window, running through mid-December, is your opportunity to enroll in or change your FEHB, FEDVIP, and FSAFEDS plans for the upcoming year. Changes take effect on January 1st. Use this time to ensure your benefits align with your life. For planning resources, visit Prepare for Open Season.

Can I participate in pharmacy incentive programs with my FEHB plan?

Yes. OPM allows participation in pharmacy incentive programs and manufacturer co-pay reimbursement programs. In fact, FEHB members are exempt from the Anti-Kickback Act restrictions that apply to Medicare and Medicaid. This means you can use co-pay cards and other savings programs to significantly reduce your out-of-pocket costs for prescription drugs.

What happens to my FEDVIP coverage if I retire?

Your FEDVIP dental and vision coverage automatically continues into retirement. There is no need to re-enroll. Once OPM is notified of your retirement, premiums will be deducted directly from your annuity. This seamless transition ensures you maintain this important coverage without any administrative hassle.

Act Now: Turn Federal Health Data into Faster Care and Lower Costs

Federal Health programs like FEHB, FEDVIP, and FSAFEDS offer a powerful benefits system for millions. Making informed choices during Open Season is crucial for maximizing your health and financial well-being.

But the true future of Federal Health lies in its data. The vast information generated by agencies like HHS, FDA, and NIH is a national asset. The challenge is open uping its value securely and at scale. When real-world health data is connected with advanced AI, it can accelerate drug findy, improve patient safety, and transform public health.

This is where data modernization is critical. At Lifebit, our federated AI platform enables secure, real-time analysis of biomedical data. Our tools, including Trusted Research Environments (TRE) and our R.E.A.L. (Real-time Evidence & Analytics Layer), allow government agencies and researchers to collaborate on sensitive data without moving it, maintaining the strictest security and compliance.

This means answering critical research questions in weeks, not years. It means detecting safety signals in real-time. It means making precision medicine a reality.

The promise of data-driven Federal Health is immense, and it requires a new generation of technology to achieve it. If you’re working to solve these challenges, learn how Lifebit’s platform can help you deliver on the future of health.

Visit us at https://lifebit.ai/federal-health/ to see how we’re powering this change.